Deposit and Withdrawal on Exness using a Bank Card

Whether you're a beginner or a seasoned trader, understanding how to deposit and withdraw on Exness using a bank card is crucial for managing your finances effectively.

Exness Deposit and Withdrawal processing time and fees

Please note that the following bank cards are accepted:

- VISA and VISA Electron

- Mastercard

- Maestro Master

- JCB (Japan Credit Bureau)*

*The JCB card is the only bank card accepted in Japan; other bank cards cannot be used.

Here’s what you need to know about using a bank card:

- You must have a fully verified Exness account before you can use a bank card for transactions.

- Only 3D secure supported bank cards are accepted.

- Bank cards cannot be used as a payment method for PAs registered to the Thailand region.

- It is recommended to fully understand how withdrawals work before deciding to use bank cards as a payment method.

| Minimum deposit | USD 10 |

| Maximum deposit | USD 10 000 |

| Minimum withdrawal |

Refunds: USD 10* Profit withdrawals: USD 3** |

| Maximum withdrawal | USD 10 000 |

| Deposit and withdrawal processing fees | Free |

| Deposit processing time | Average: Instant*** Maximum: up to 5 days |

| Withdrawal processing time | Average: Instant*** Maximum: up to 10 days |

*Minimum withdrawal for refunds is USD 0 for web and mobile platforms, and USD 10 for the Social Trading app.

**Minimum withdrawal for profit withdrawals is USD 3 for web and mobile platforms, and USD 6 for the Social Trading app. Social Trading is unavailable for clients registered with our Kenyan entity.

***The term “instant” indicates that a transaction will be carried out within a few seconds without manual processing by our financial department specialists. However, this does not guarantee that a transaction will complete instantaneously, but that the process is begun instantly. This does not guarantee that the deposit/withdrawal will be completed instantaneously, but that the process is begun instantly.

Note: The limits specified above are per transaction unless mentioned otherwise. Please refer to your Personal Area for the most up to date information.

Deposit on Exness

Any bank card used to make a deposit is automatically saved as an option for further deposits. It is not possible to remove bank cards from your PA without contacting Support and providing proof this bank card is no longer active.Note: payment methods requiring profile verification before use are grouped separately in the PA under the Verification required section.

For new bank cards

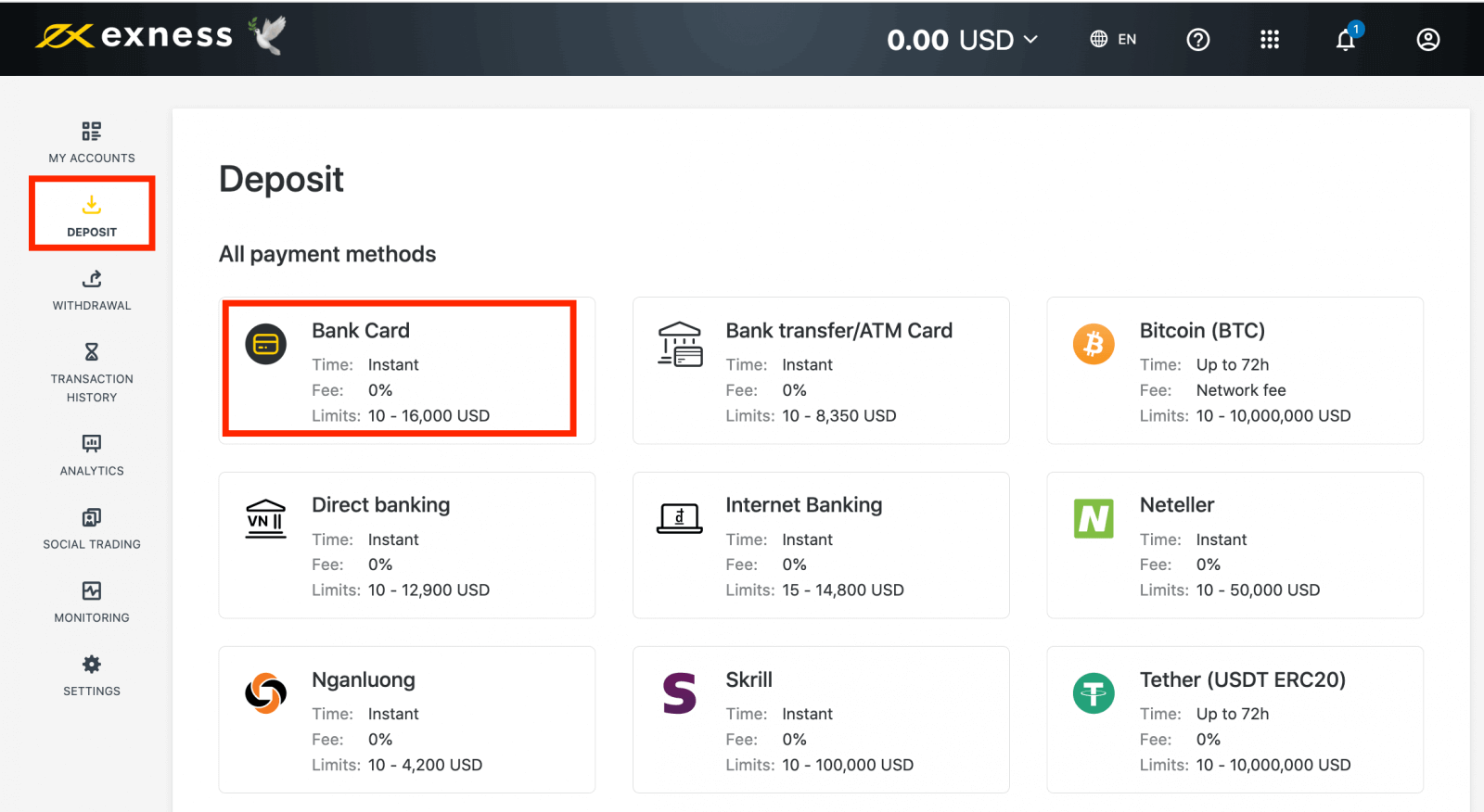

1. Select Bank Card in the Deposit area of your Personal Area.

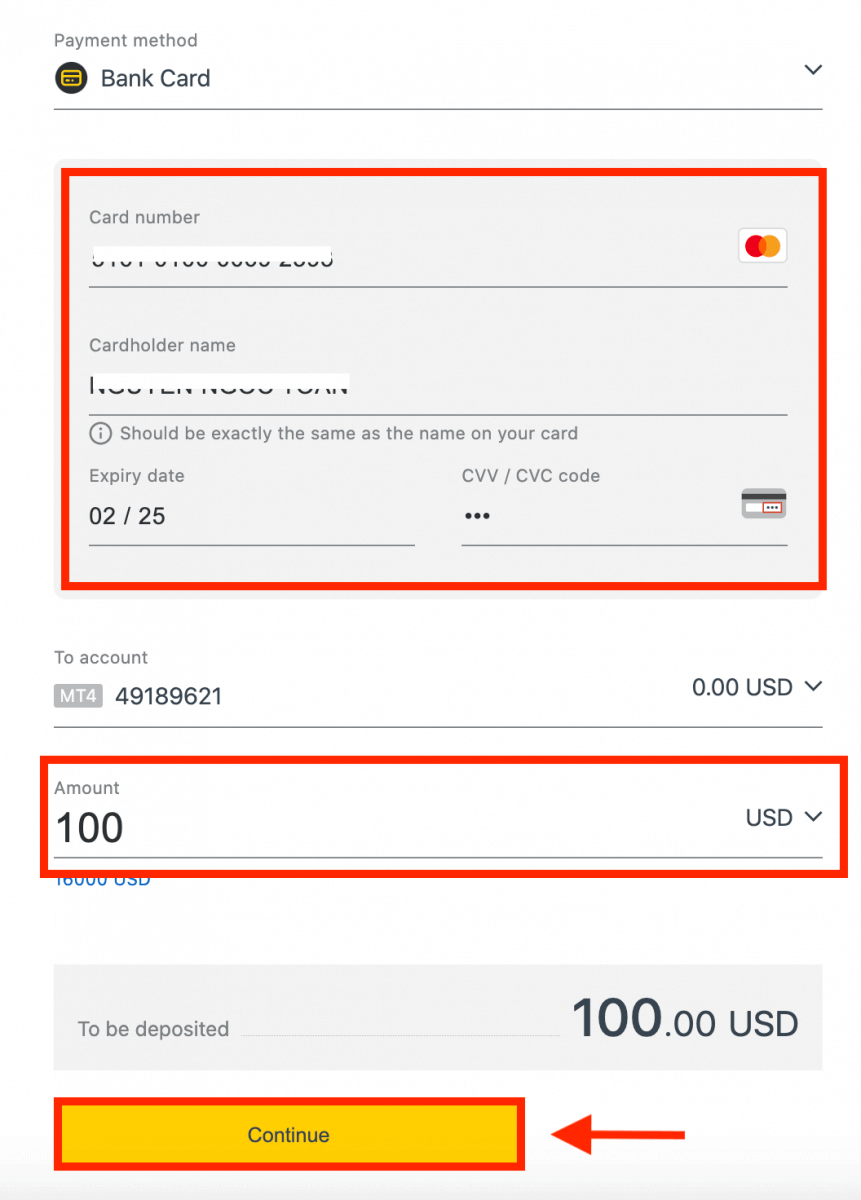

2. Complete the form including your bank card number, cardholder’s name, expiry date, and the CVV code. Then, select the trading account, currency and deposit amount. Click Continue.

3. A summary of the transaction will be displayed. Click Confirm.

4. A message will confirm the deposit transaction is complete.

In some cases, an additional step to enter a OTP sent by your bank may be required before the deposit transaction is completed.

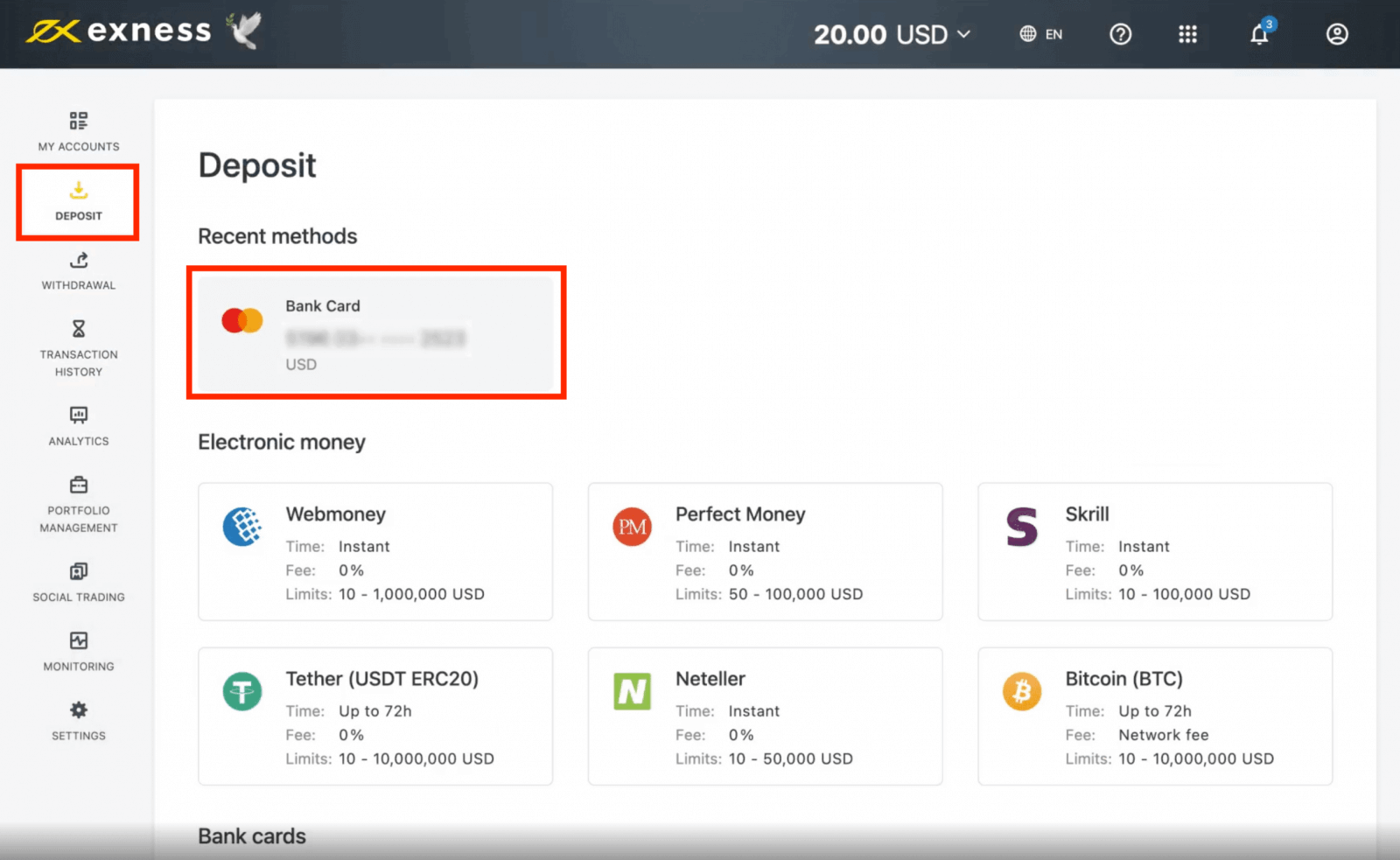

For existing bank cards

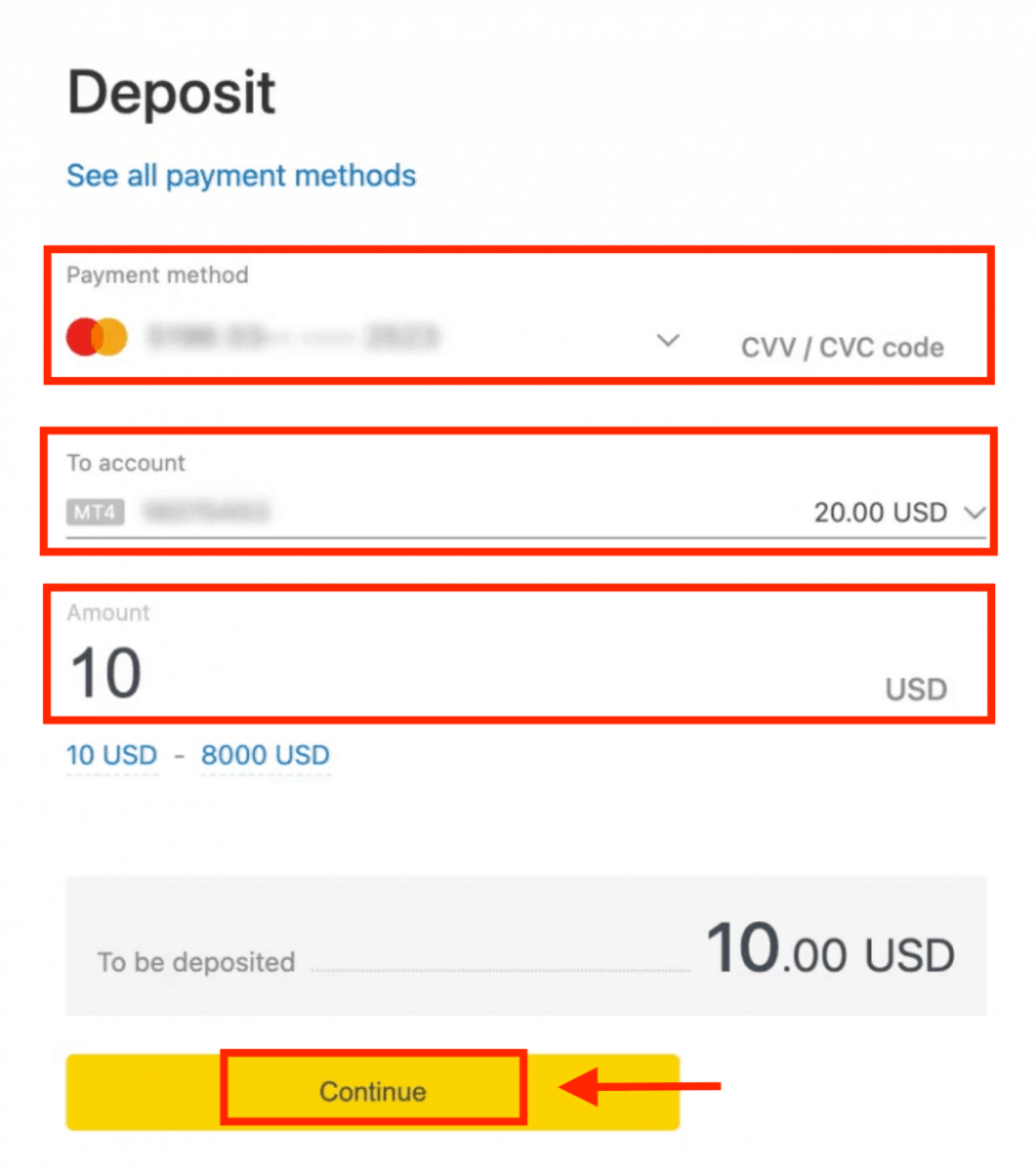

1. Select Bank Card in the Deposit area of your Personal Area.2. Select an existing bank card from the dropdown menu and enter the CVV code.

3. Select the trading account, currency and deposit amount, then click Continue.

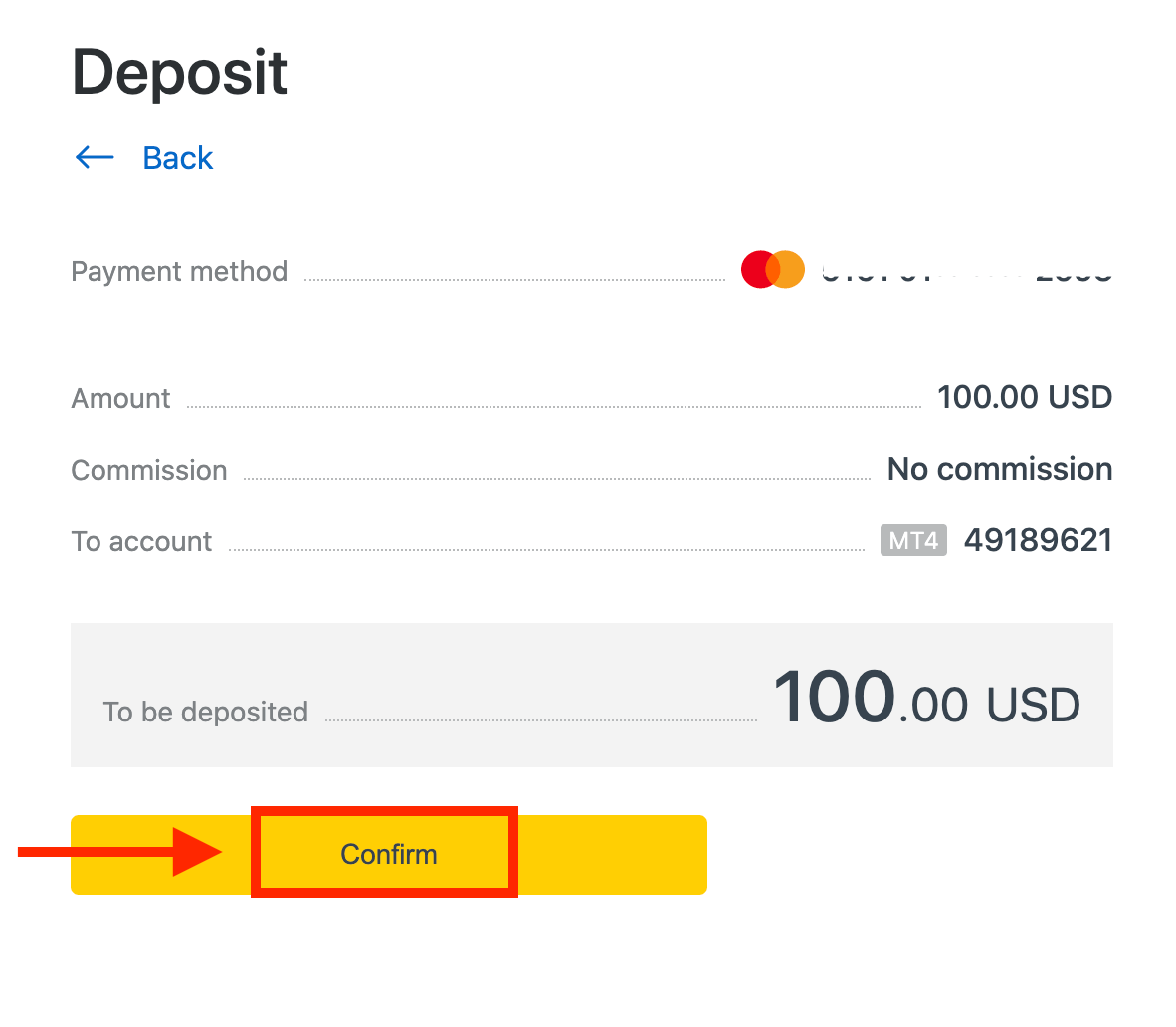

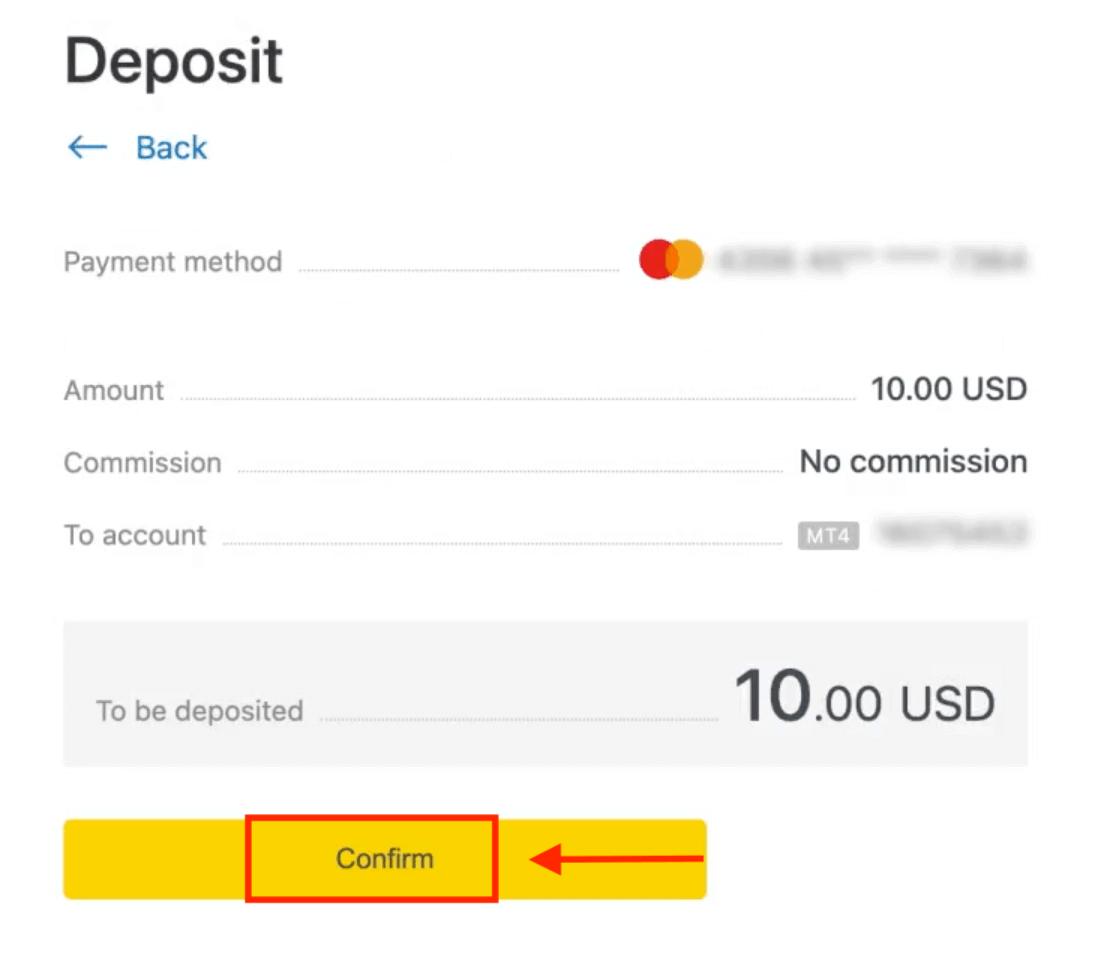

4. A summary of the transaction will be displayed. Click Confirm.

5. A message will confirm the deposit transaction is complete.

Withdrawal on Exness

As per Exness withdrawal rules, deposited funds and profit must be withdrawn separately. Withdrawing deposited funds is referred to as a refund request, while withdrawing profit from your trading account is its own operation. Only once all refund requests have been completed will you be able to withdraw profit to your bank card, unless you wait 90 business days from the date of deposit. Partial refund requests are available and can be done in parts until the total refund amount is met.

Payment method proportional withdrawals

A withdrawal must be made using the same payment system, same account, and same currency used as for the deposit. If you have used a number of different bank cards and/or payment methods to deposit funds into your trading account, withdrawals are to be made to those same bank accounts and/or payment systems in the same proportion as the deposits were made.

Example: You’ve deposited USD 1 000 total into your account, USD 500 with one bank card (bank card A), USD 300 with a different bank card (bank card B), and USD 200 with Neteller. As such, you’ll only be allowed to withdraw 50% of the total withdrawal amount through bank card A, 30% through bank card B, and 20% through Neteller. Let’s assume that you’ve earned USD 500 and wish to withdraw everything, including profit.

As per the rule of proportions, here are the maximum limits for each method of withdrawal:

- Card A - USD 750 (USD 500 to be returned as a refund first, remaining USD 250 profit withdrawal)

- Card B - USD 450 (USD 300 to be returned as a refund first, remaining USD 150 profit withdrawal)

- Neteller - USD 300

Note: Profit withdrawals are only available once refund requirements have been met; this is shown in your Personal Area as you make a withdrawal.

The purpose of the payment priority system is to ensure that Exness follows financial regulations forbidding money laundering and potential fraud, making it an essential rule without exception.

About refund requests

A refund request is a withdrawal of deposited funds and must be completed before profit from a trading account can be withdrawn. Refunds with bank cards cannot be bigger than what was deposited and must exceed the refund requirements shown in your Personal Area when making the refund request.

The maximum amount that can be made during a refund request is the smallest amount of either the balance of what is available in your trading account, or the cumulative amount deposited with bank cards since the last refund request (if applicable).

Refund request processing times

Typically refunds take up to 10 business days; if you face a longer processing time we suggest you contact the Support team with a bank statement (in pdf format) of your account from the date of withdrawal to the present day.

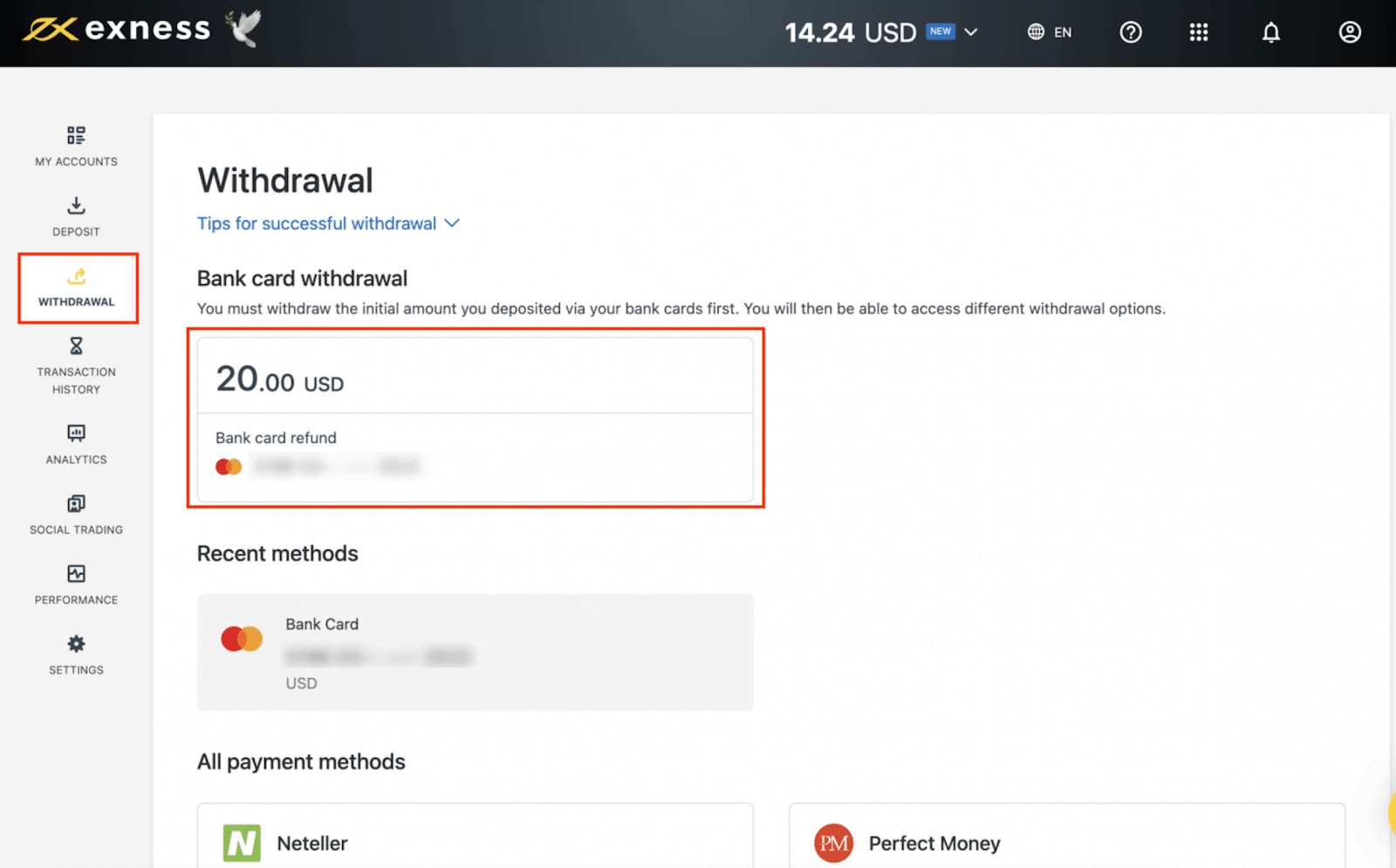

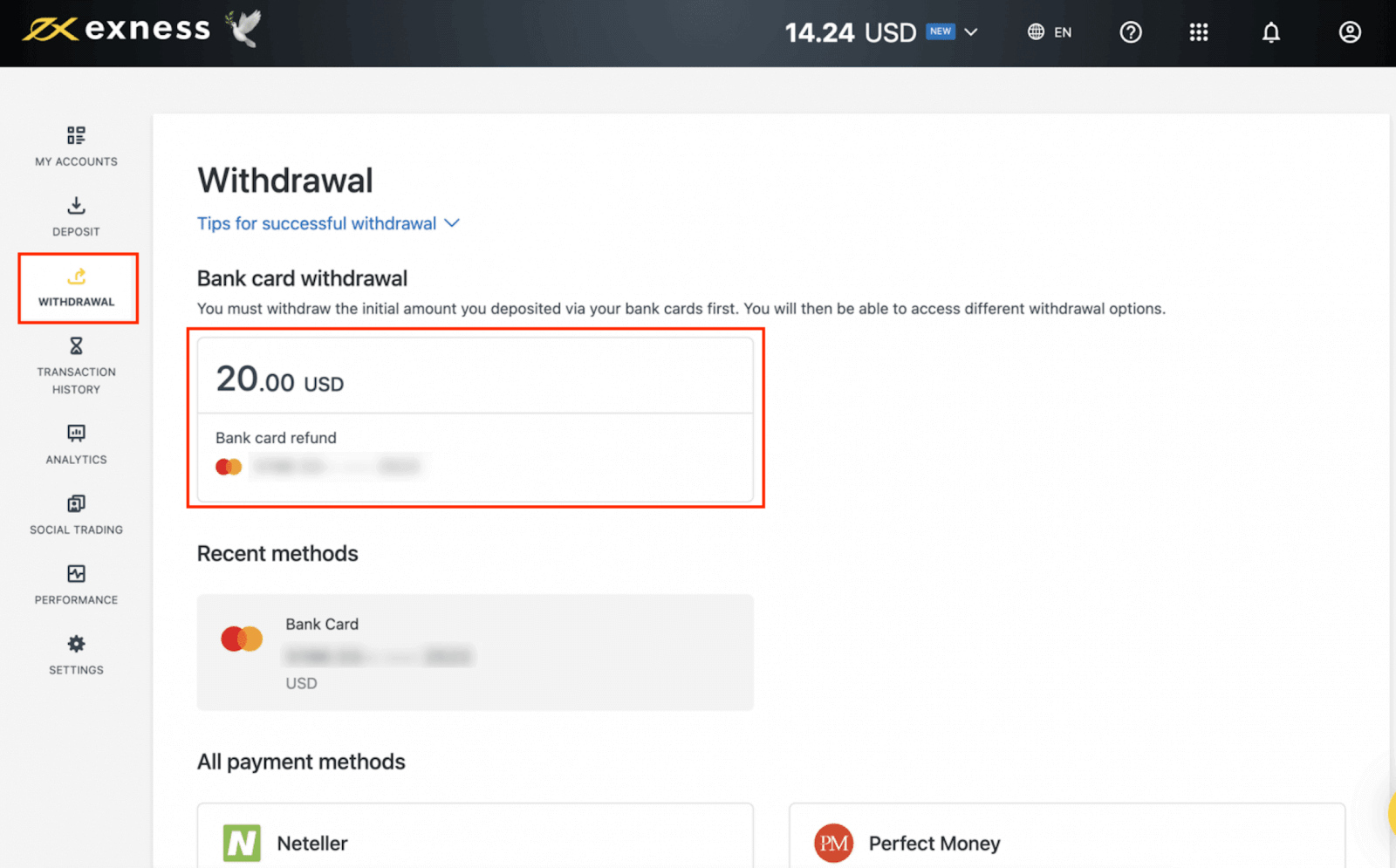

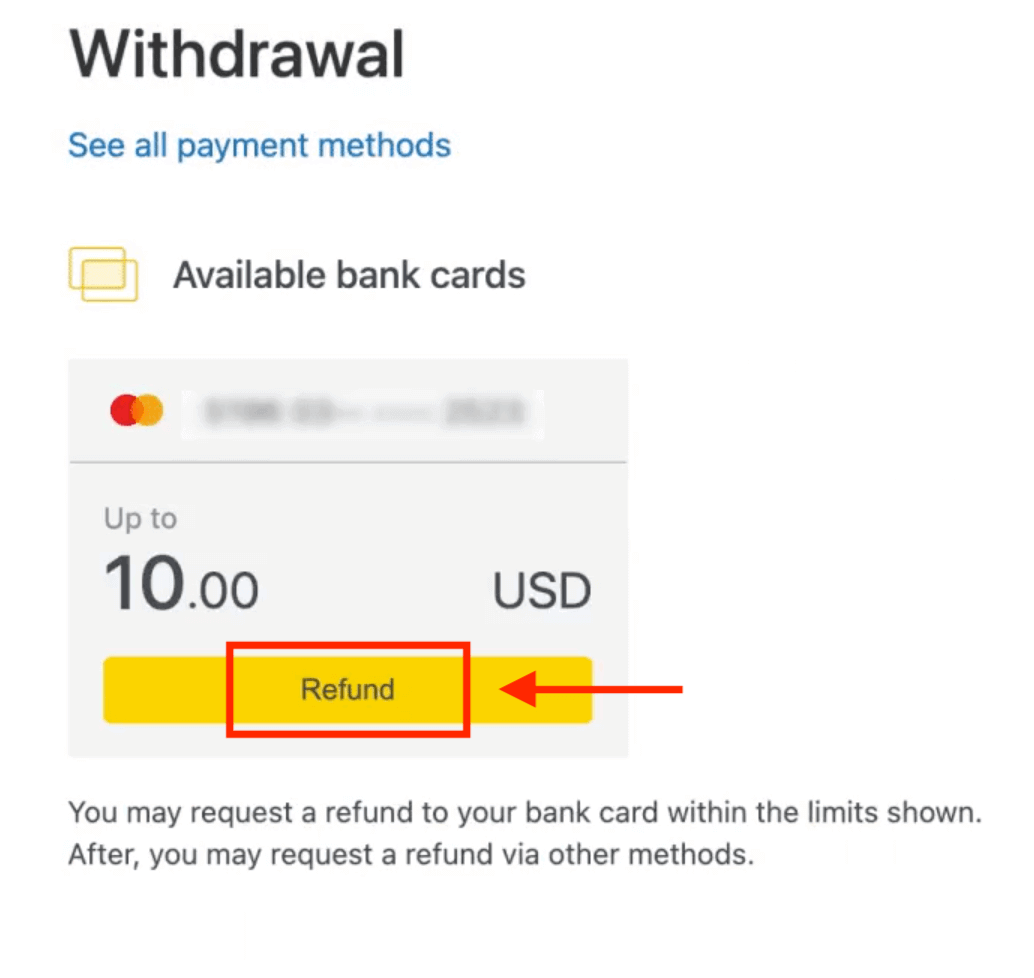

If you still need to make a refund request to a bank card, a notification will be displayed in the withdrawals area of your PA; click Show available options to pick the card and start the refund process.

If you make a refund request within 24 hours of your deposit, the refund process will take 3-5 business days.

How to request a refund

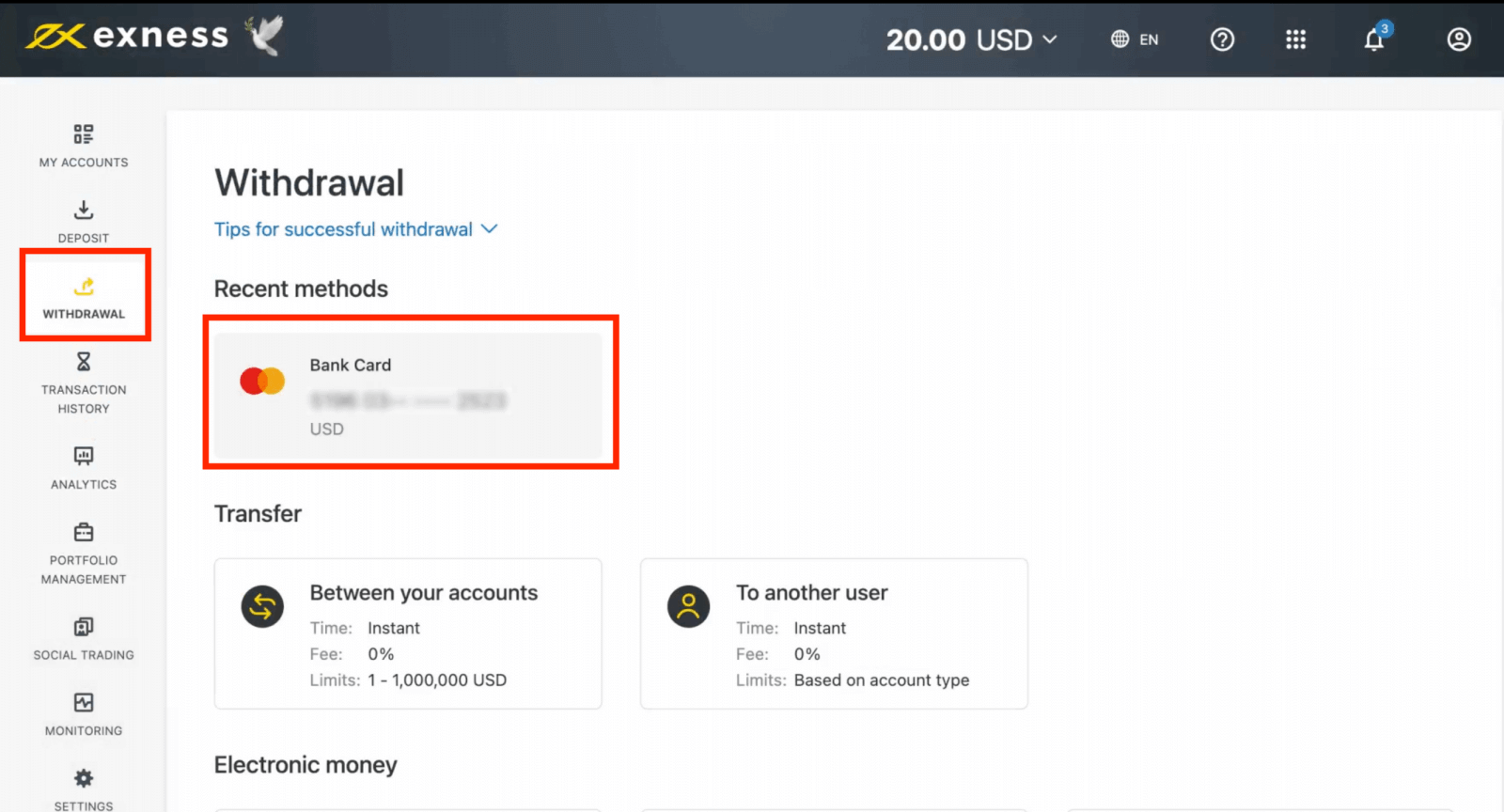

1. In the Withdrawal area of your Personal Area, click on Bank card.

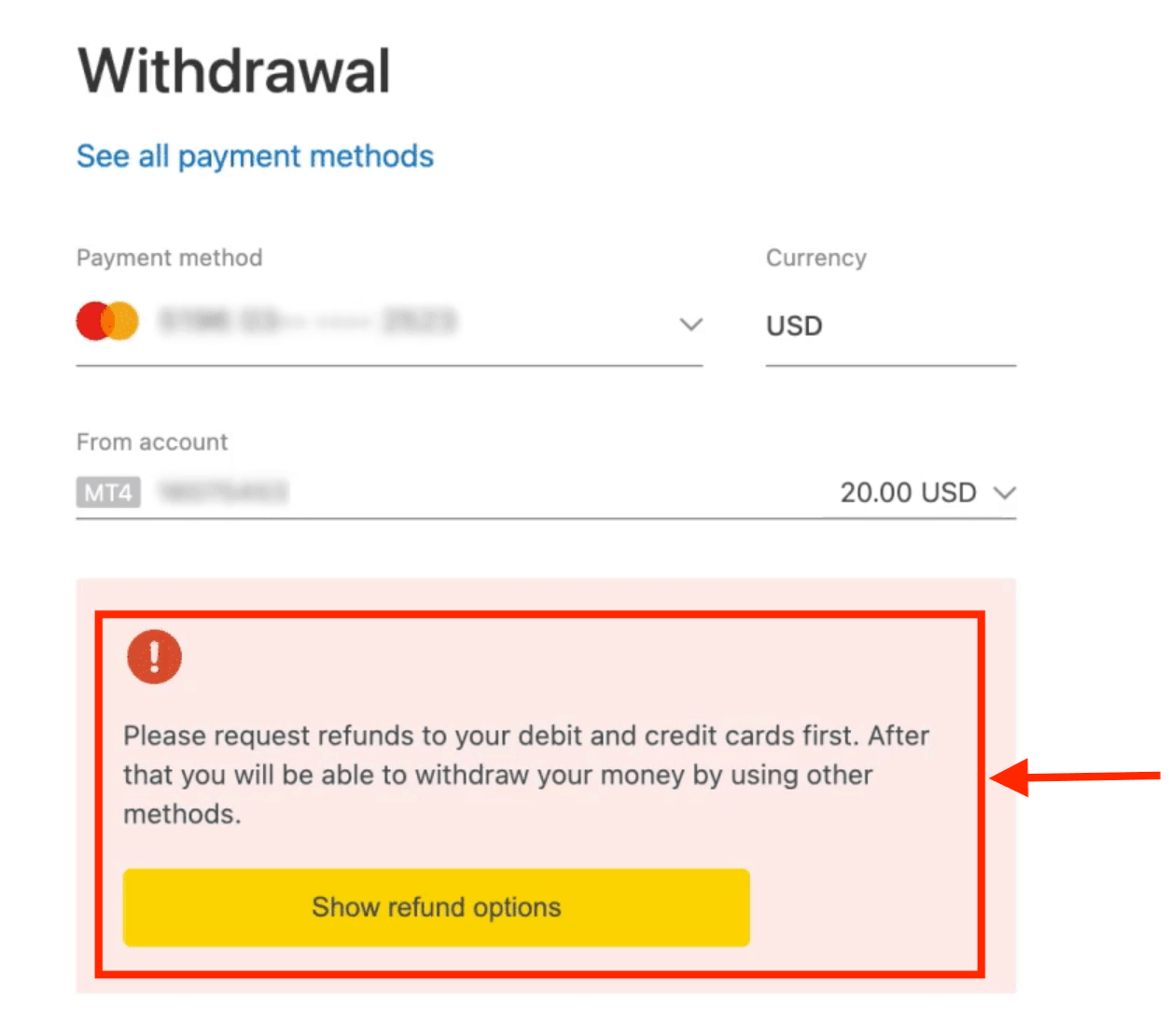

2. If there are refunds pending, you will see a prompt. Click Show refund options.

3. Click Refund under the card you would like to use to make your withdrawal.

4. Fill in details like amount and currency. Click Continue.

5. A transaction summary will be presented; click Confirm to continue.

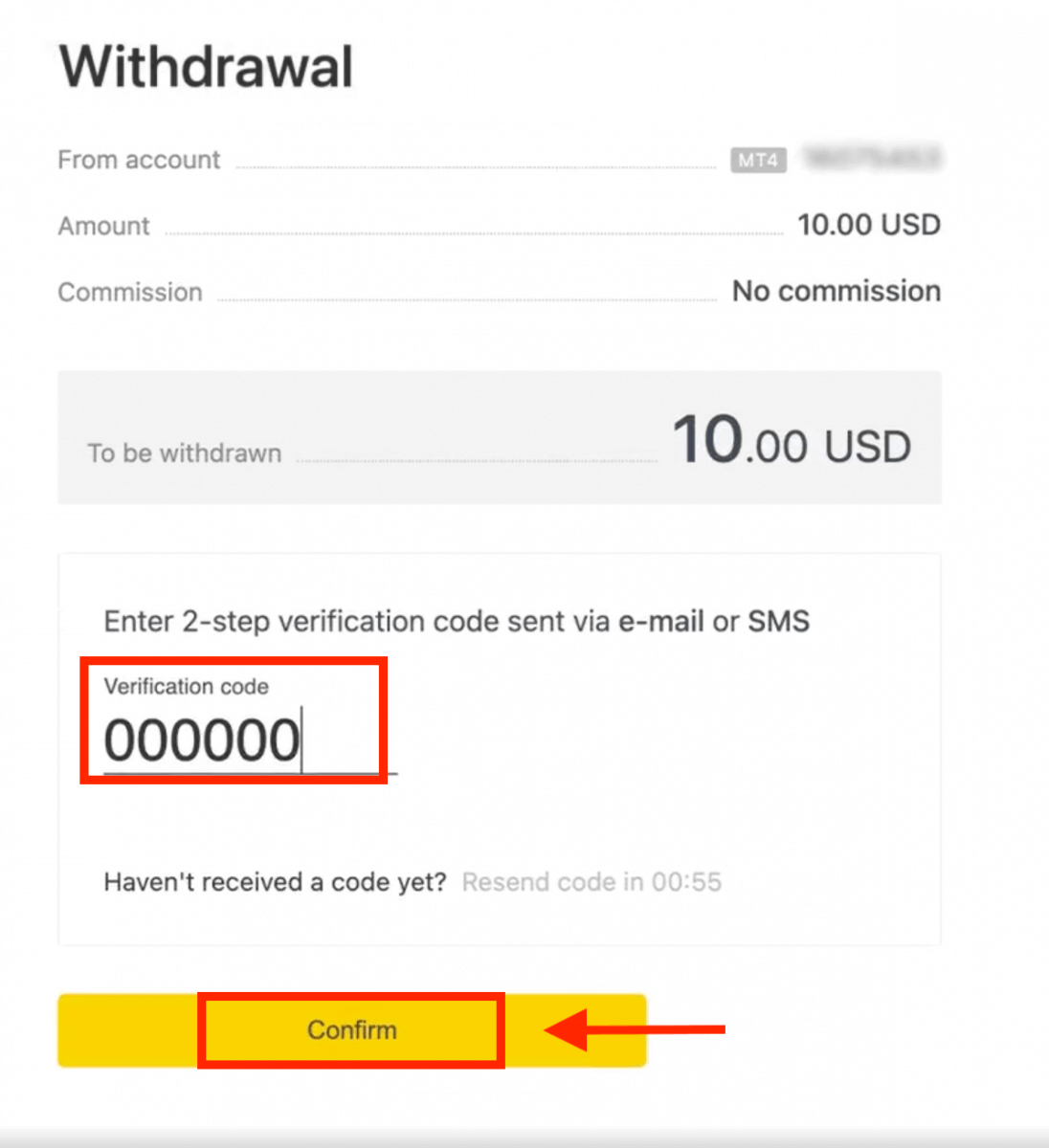

6. Enter the verification code sent to you either by email or SMS (depending on your Personal Area security type), then click Confirm.

7. A message will confirm the refund request is complete.

Expired bank cards

If your bank card has expired but you have been issued a new bank card for the same bank account, the refund process is straightforward; you only need to follow the steps to request a refund as normal.If your expired card is no longer linked to a bank account as it has been completely closed, you must contact the Support Team with proof of the closed bank account. The Support Team can then guide you through a refund request, making use of other available payment methods or Electronic Payment Systems (EPS).

Lost or stolen bank cards

In the event of a lost or stolen bank card, please contact the Support Team with proof and they can assist you with your refund request once account verification has been completed.

How to withdraw profit

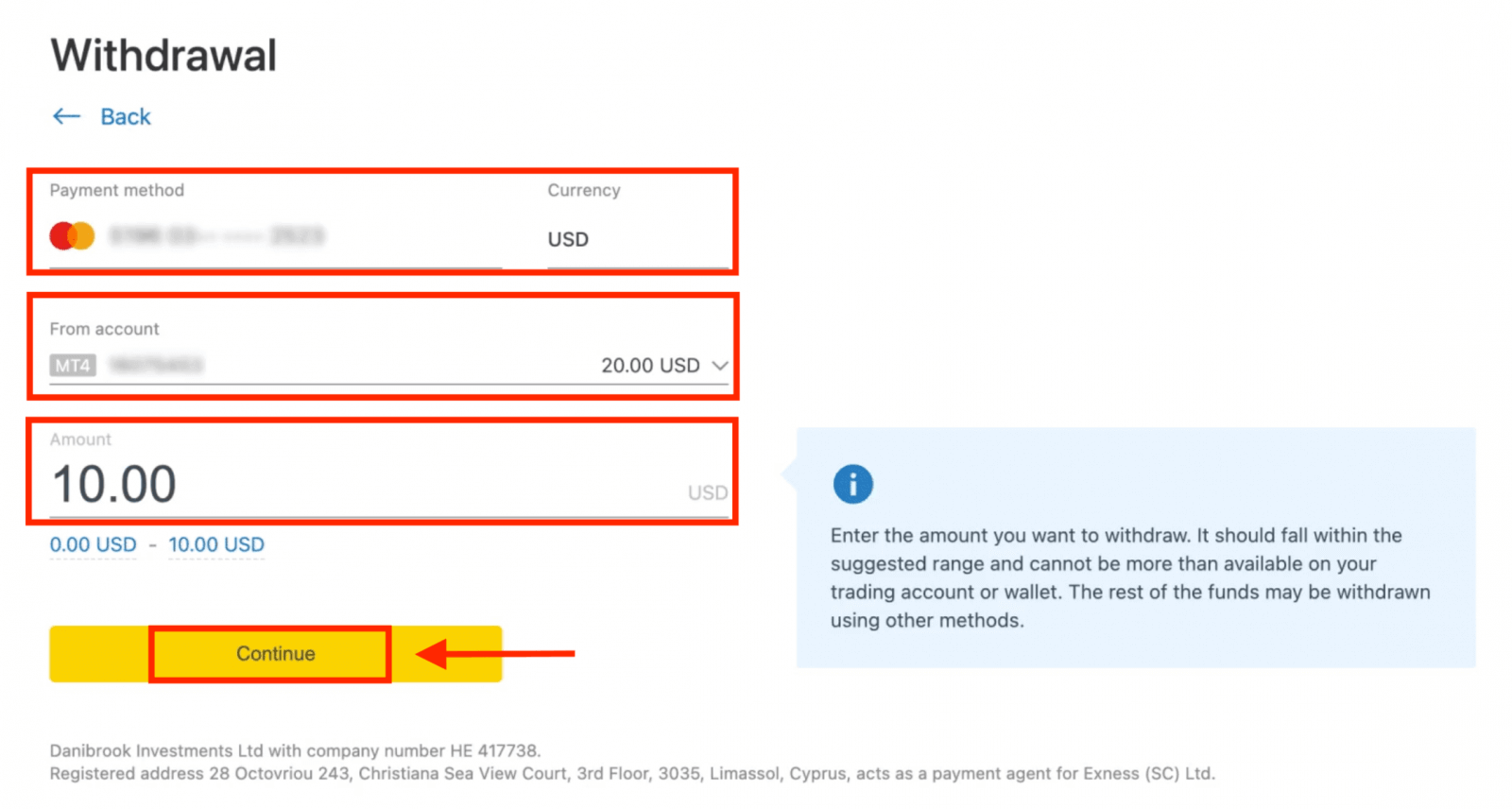

The minimum amount you can withdraw to your bank card is USD 3 for web and desktop PAs or USD 6 for the Social Trading app, while the maximum profit withdrawal is USD 10 000 per transaction.1. Select Bank Card in the Withdrawal area of your Personal Area.

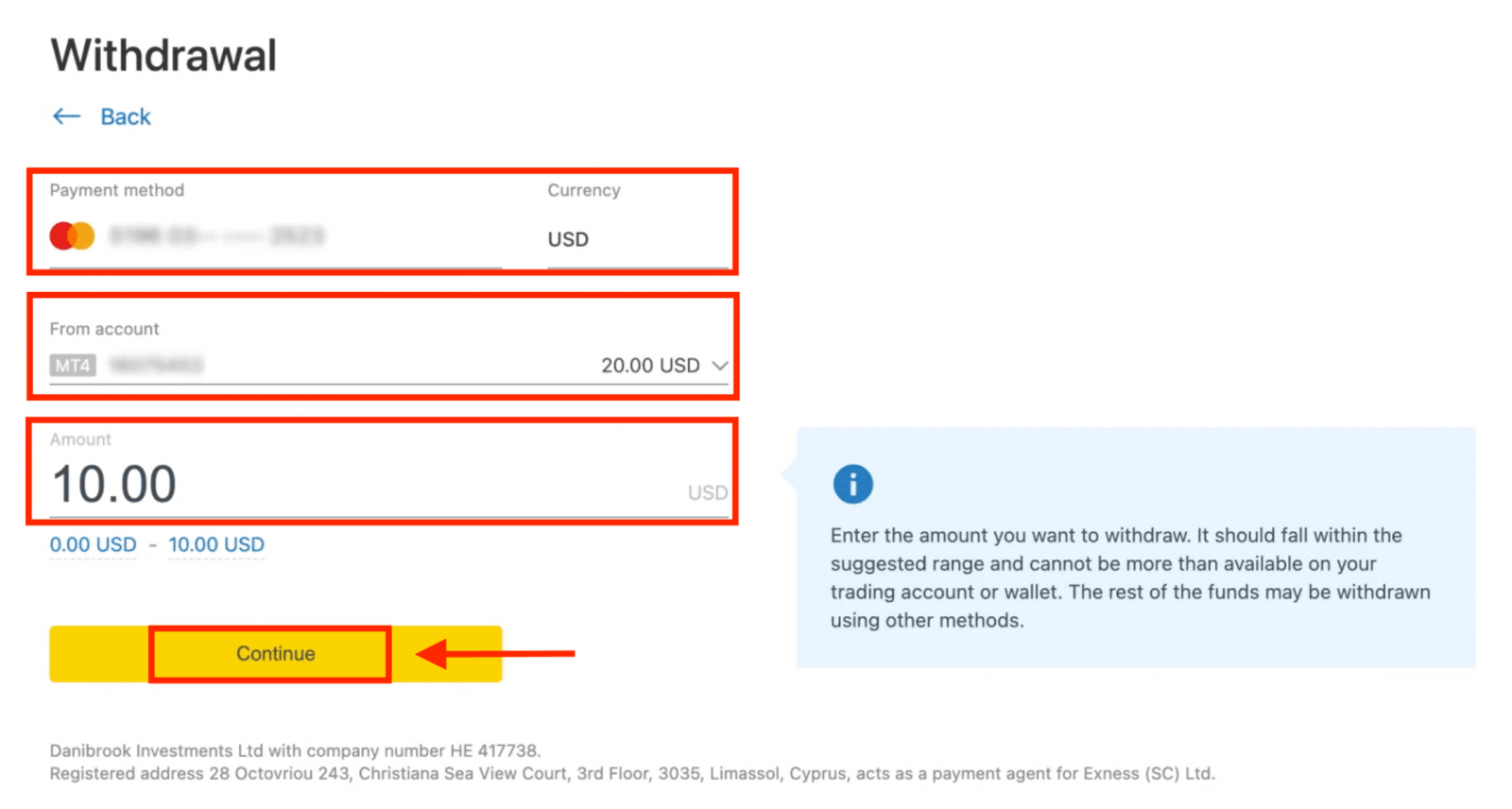

2. Complete the form, including:

b. Choose the trading account to withdraw from.

c. Enter the amount to withdraw in your account currency.

Click Continue.

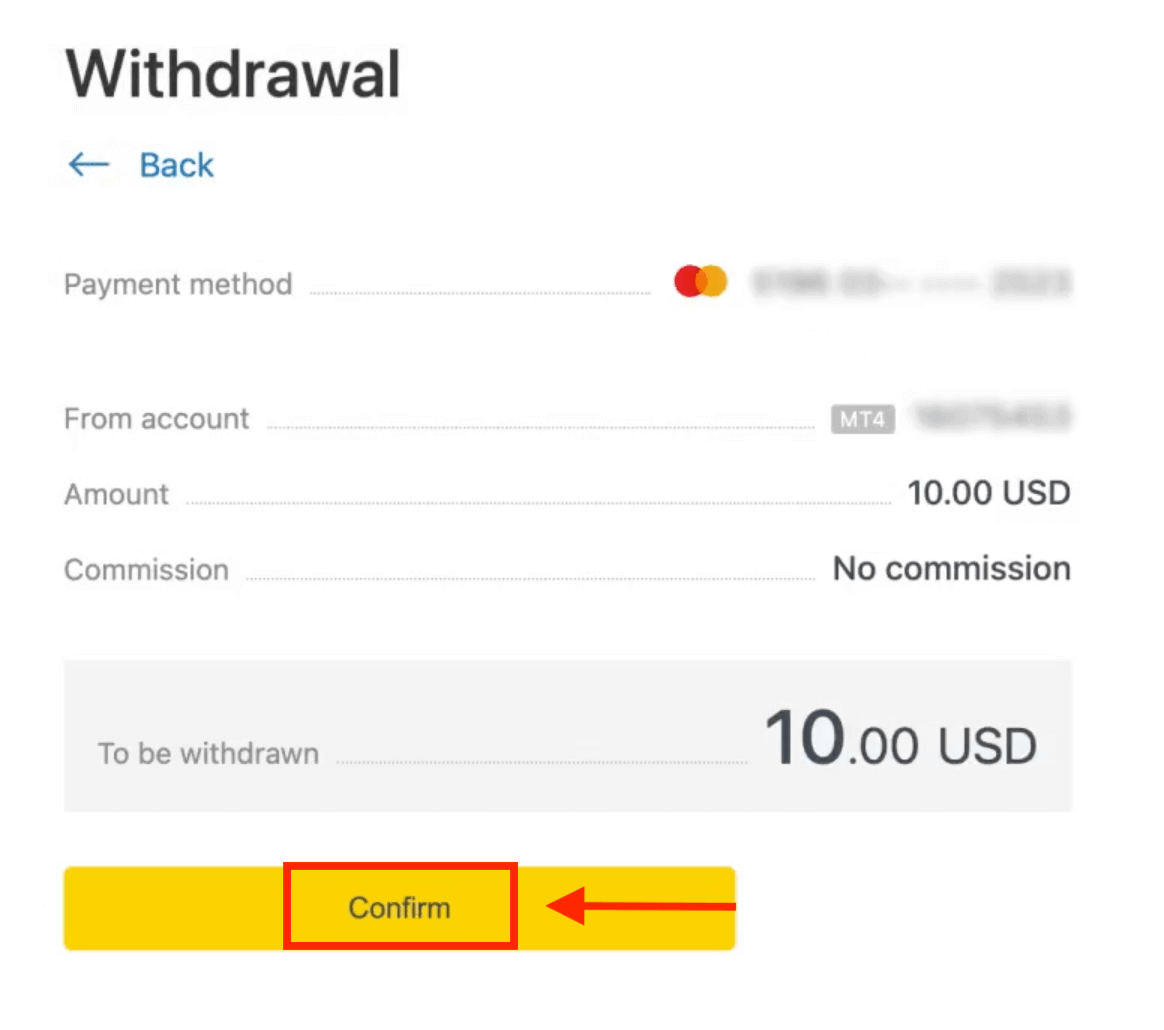

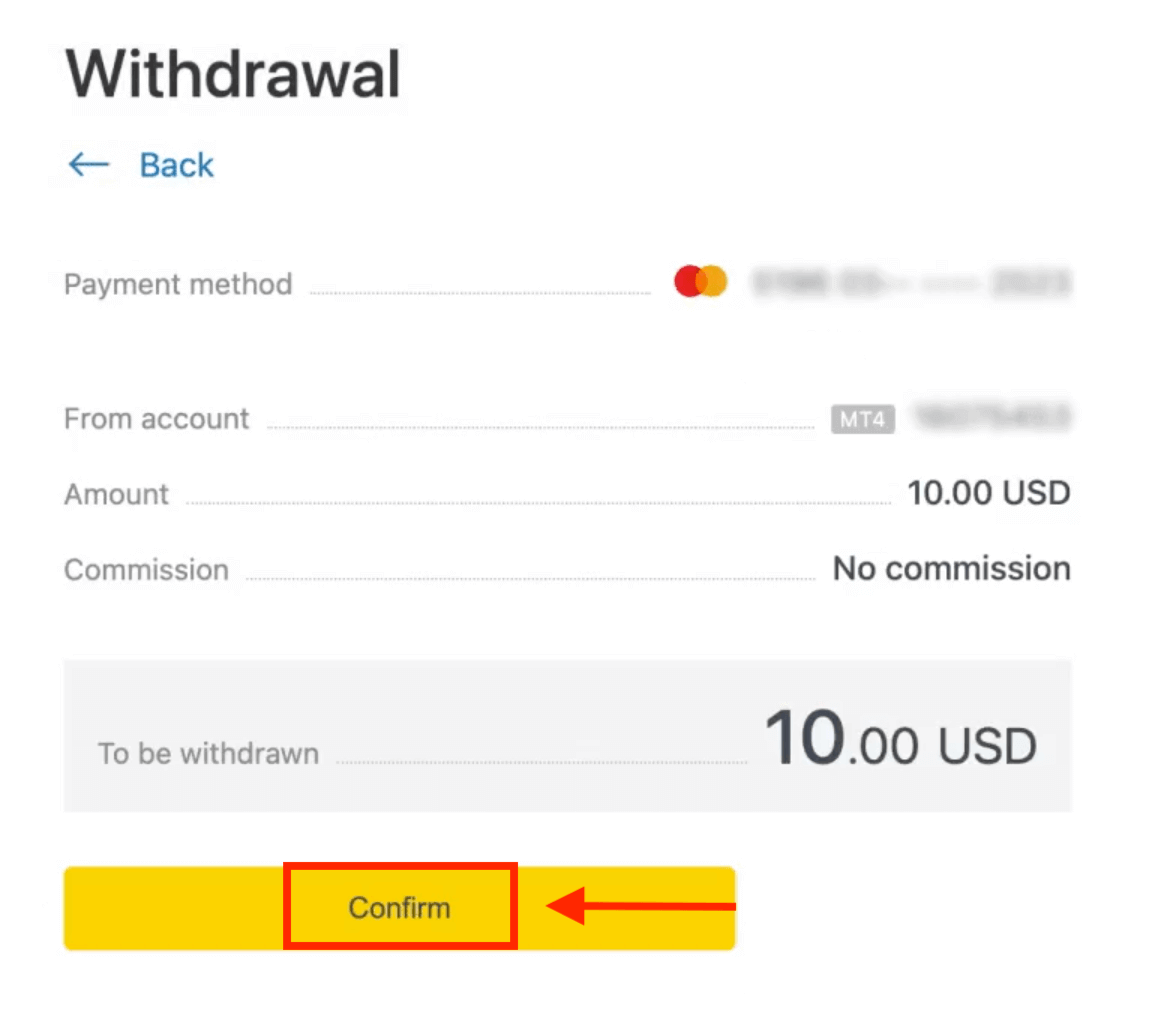

3. A transaction summary will be presented; click Confirm to continue.

4. Enter the verification code sent to you either by email or SMS (depending on your Personal Area security type), then click Confirm.

5. A message will confirm the request is complete.

Conclusion: Effortless Transactions with Exness

Exness makes it easy for traders to deposit and withdraw funds using a bank card, ensuring smooth transactions while prioritizing security. Whether depositing funds or withdrawing profits, the process is designed to be user-friendly and efficient. By following the steps outlined above, you can manage your trading finances with confidence, keeping your focus on the markets.